Market Analysis Family Life Cyle College Savings Plan

As a new parent, yous have a lot on your plate. You have an entirely new set up of demands on your time and energy, and you are trying to navigate the many unknowns of parenting. Preparing for something 18 years into the future is unlikely to be your tiptop priority. Yet, with college education costs having skyrocketed over the past few decades and the application procedure condign ever more than competitive, it is never too early to begin thinking about your child's college pedagogy.

To assistance gear up yous for one of the near pregnant financial and educational undertakings that you will ever meet, Pekin Hardy Strauss has partnered with Valle Educational Consultants to develop a roadmap called The College Planning Lifecycle. In this iii-part commodity series, we will assist you understand this lifecycle and provide you with strategies for managing the challenges it poses for families. We will examine three stages in our serial equally follows:

- Phase ane: The Early on Years

- Stage 2: The Loftier School Years

- Phase three: Grandparents Tin Assist, Besides

Stage 1: The Early Years

In part 1 of this guide, nosotros volition provide important data for families with young children. At this early on stage, you may be wondering what, if anything, yous can do to prepare for something that may be many years away. This guide provides our suggestions for ways to begin to set yourself financially and your children educationally and emotionally for this important undertaking.

Preparing Yourself: Creating a College Savings Programme

Equally a new parent who is already thinking nearly higher, you have given yourself one meaning advantage: time. One of the most of import actions you lot can take for yourself at this stage is to begin to relieve for your child'southward education, giving yourself a longer time period over which to put money aside.

As with any fiscal planning topic, there is no i-size-fits-all approach when information technology comes to saving for higher, so we encourage you to contact u.s.a. to discuss your unique situation and to develop an individualized plan for meeting this financial goal. Yet, we hope this guide will assistance y'all amend sympathise the college saving procedure and provide you with a framework for outset to think about this important topic.

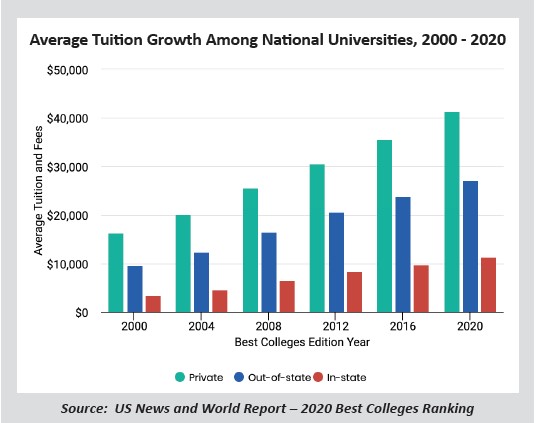

Especially if your children are very immature, there may exist many unknowns around their education, only one affair is certain: college is expensive and getting more than so every year. As the nautical chart below illustrates, average tuition costs among national universities have soared over the past 20 years. Tuition at private universities has increased at an average rate of 4.8%, while out-of-country and in-state public academy tuition has increased at an boilerplate rate of 5.iii% and half-dozen.0%, respectively. These increases in education costs have outpaced the increment in the broader price of living (as measured by the Consumer Cost Index) by two.6%, 3.one%, and 3.viii% per year, respectively, over this time frame. While there is no guarantee that education costs will continue to increase at these rates going frontward, the numbers certainly fence for planning and preparation by parents who wish to assist their children with higher education costs.

How to Save: 529 Plans vs. Custodial Accounts

One important consideration for parents at the beginning of this process is only where to put their college savings. To facilitate families' college savings efforts, several savings vehicles take been created that enjoy diverse taxation advantages and levels of investment flexibility, just also come with their own rules and regulations. 529 plans and custodial accounts are 2 of the virtually common ways to save for college, but they have distinctly different benefits for families. Understanding the differences between the two savings methods is essential to choosing the correct one for you and your children.

There are 2 basic types of 529 plans: general savings plans and prepaid tuition plans. A savings program only allows the parent to put aside coin for whatever college expenses, whereas a prepaid tuition plan allows a parent to pay for future tuition at today's rates.1 Every state has its own programme and may offer either 1 or both types. Parents aren't limited to 529 savings plans with their land of residence (though at that place are often fiscal incentives to do then).

A custodial account is a taxable investment account that is opened on behalf of a child. There are two types: Uniform Transfers to Minors Act (UTMA) accounts and Uniform Gift to Minors Act (UGMA) accounts. UGMA accounts are express to assets similar greenbacks, securities, and annuities, whereas UTMA accounts can hold virtually whatever kind of asset. In both cases, a custodian sets upwardly the account for a modest and controls the account until the small reaches legal adulthood.

How Much Tin I Save Each Year?

On an annual basis, in that location is technically no limit to the corporeality a parent can contribute to a child's custodial account or 529 program, but gifts higher up a certain threshold ($15,000 per parent in 2020) may accept lifetime gift tax consequences. In a 529 plan, a parent can besides make a lump-sum souvenir to embrace 5 years of programme contributions with no gift tax consequences; in 2020, one parent could contribute $75,000 or a married couple could contribute $150,000 with the 5-yr election option. Parents using custodial accounts accept no such lump-sum contribution option. Neither 529 plans nor custodial accounts have contribution limits based on income, so fifty-fifty loftier-earning parents are able to save into these vehicles.2

College Planning and Taxes

A 529 program is a tax-beneficial way to save for college, at to the lowest degree at the indicate at which y'all withdraw funds to pay for educational expenses. Contributing to a 529 program does not provide any Federal tax benefit, but it may provide relief on land taxes.

Withdrawals from a 529 programme, however, receive very favorable tax treatment. The investments in a plan grow tax-free, and equally long as the funds are used for educational purposes, no taxes are owed upon withdrawal of the funds.three In this respect, a 529 is somewhat akin to a Roth IRA, with the taxation-costless distributions used for college instruction rather than retirement.

There are no special revenue enhancement benefits to using funds for instruction with a custodial business relationship. Gains in the account are typically taxed at "kiddie revenue enhancement" rates rather than the custodian's income tax charge per unit. Before the child turns eighteen, interest and dividends may be taxed if they total more $2,100.

Weighing the Pros and Cons

Parents choosing betwixt 529 plans, custodial accounts, or simply paying tuition direct have to consider the pros and cons of each programme, their own financial situation, and their child when deciding which to utilise. A 529 plan can offer the parents considerable tax benefits, but only if the money is used for educational expenses. Custodial accounts do not accept the same usage restrictions, making them far more than flexible, but they as well lack the pregnant tax benefits of a 529 program.

Paying tuition without the use of 1 of these savings vehicles also has advantages, every bit a payment made directly to the school does not count towards the annual or lifetime gift taxation exclusion. For parents with significant assets, this can be a practiced mode to pass wealth to their children.

Some other important consideration for some families is how their college savings volition affect a child'southward financial help eligibility. Because a custodial account transfers assets to the child'due south estate, these accounts often accept a greater effect on fiscal aid eligibility than a 529 plan, which leaves the coin in the parents' estate.

Parents who are trying to determine which account is well-nigh advisable for their family should consider all of the differences above and perhaps consult with a trusted financial advisor for help making the choice.

How Much Should I Salve?

Determining how much to set aside for a child's didactics costs can exist tricky, because it is incommunicable to know exactly how college costs will evolve over time, and the assumptions involved are highly dependent on the educational aspirations of the kid. In that location are numerous online college savings calculators that are available. We accept found the calculator provided by The College Lath to be useful in providing an gauge of potential higher costs and the level of saving that would exist necessary to fund those costs.4

Nosotros empathize the magnitude of the challenge that parents face with respect to saving for their children'due south college educations. With limited resource, of import savings decisions must exist made, and we would urge parents to always prioritize retirement savings above education savings. Financing for didactics is readily available, while the aforementioned cannot be said for retirement: you cannot borrow to pay for your retirement. However, in general, nosotros encourage parents who wish to assist fund their children'south college educations to start thinking seriously virtually this goal equally early as possible and to brainstorm committing capital as soon equally they are willing and able. In that location are additional timelines that come up into play if a student wishes to employ for college fiscal help and/or scholarship dollars. In this case, nosotros would urge a family unit to begin exploring options no subsequently than the student's freshman yr in loftier school to all-time gear up for lower college costs. And, of class, we are here to assist our clients understand the challenges posed by education costs and to develop a thoughtful plan for meeting those challenges.

Preparing Your Children:

Laying a Solid Foundation & Building on It

Our role as parents is to prepare our children to be independent people with the power to navigate life's challenges and hopefully thrive. Although the college admissions process typically starts in the subsequently years of high school, an effective foundation should be built starting in the early years — fostering a kid's interests and natural skills and and then providing opportunities to explore those interests and hone skills.

The early childhood years (Pre-Kindergarden-fifth grade) are all about edifice muscle — setting realistic expectations, encouraging autonomy where appropriate, and assuasive mistakes and the consequences to unfold in order to teach important lessons. The early years are the fourth dimension to model behaviors you ultimately expect of your kid. When it comes to life's big discussions, your child volition struggle less with expectations equally the pattern was ready in motility since childhood. With an awareness toward age-appropriate interactions, encourage your kid to engage i:1 with older children and adults. Rehearse disquisitional interpersonal skills like shaking easily, good eye contact, and active listening skills. It'south important for children to practice verbalizing their feelings and talking through dilemmas, solutions to resolve them, and noting lessons learned. Troubleshooting and redirecting for time to come efforts are critical to building cocky-confidence and skills related to private or collaborative work in school, college, and career.

Intellectual curiosity should be stimulated early and oftentimes. No matter what the involvement area, encourage children to read. Does your child have an bent for math? Love to write, describe, and/or build? Do they like ballet or play violin? Soccer, volleyball or chess? Are they curious about nature or how a reckoner works? Dial-in on what makes your child unique.

As our earth is growing ever more interconnected, a long-standing trend for higher education has been to seek out candidates that have a passion for helping others and/or improving their surroundings. A concerted effort engaging in community service may matter on a college resume and ultimately makes the world a improve place. Feeling compassion for another'south plight may non always come up naturally and can be fueled by an advocacy mindset that needs to be nurtured. You lot might cultivate compassion through family chore assignments at home. Or, become involved with your kid in an issue close to the family unit'due south heart in a neighborhood or community. Planting seeds to inspire your child will yield a natural tendency for them to seek out opportunities to help others, preferably balanced with a dose of humility and a desire to take a positive impact.

In middle school, information technology's all about continuing to build upon an established foundation. For a young student to miraculously accept an appreciation for college costs as the time approaches is non realistic. Discuss whether the student ultimately will exist contributing money in the course of earnings or scholarship to offset higher costs – well before loftier schoolhouse. Understanding the value of money is of import for a child and tin accept far reaching benefits no matter the college or career path.

Every bit a parent of a immature kid, it can be tempting to focus only on the twenty-four hours-to-solar day responsibilities associated with raising your kid (and at that place are many!) and letting the future worry about itself. Nonetheless, as we have shown, you have an opportunity to significantly improve your child's long-term educational prospects by starting to prepare yourself and your kid in these early years. In Role 2 of this serial, we will discuss how y'all can build on this foundation as your kid enters and progresses through high school.

[one] Some states offer pre-paid tuition plans for in-land public institutions that allow families to lock in a guaranteed tuition cost, regardless of how much costs might increase prior to a kid'due south matriculation. Funds invested in pre-paid tuition plans tin can exist used at private and out-of-land institutions, though only on a dollar-for-dollar basis.

[2] How much can y'all contribute to a 529 programme in 2020?, Saving for College

[3] 529 Program assets used for purposes other than qualified education expenses are subject field to a 10% penalty, equally well equally applicable Federal and state income taxes. Visit the IRS website for a description of qualified education expenses.

[4] Higher Savings Calculator, College Lath

This article is prepared by Pekin Hardy Strauss, Inc. ("Pekin Hardy", dba Pekin Hardy Strauss Wealth Management) and Valle Educational Consultants (VEC), for informational purposes only and is not intended as an offer or solicitation for concern. The data and data in this article does not establish legal, tax, accounting, investment or other professional person communication. The views expressed are those of the author(southward) as of the date of publication of this written report, and are subject to modify at whatsoever time due to changes in market or economic weather condition. Pekin Hardy cannot assure that the strategies discussed herein will outperform any other investment strategy in the future, there are no assurances that any predicted results volition actually occur.

Valle Educational Consultants (VEC) is a Chicago-based higher admissions informational do. Specialists in the higher admissions procedure, they guide and empower families and their students based on each unique situation. VEC is defended to providing information in a supportive way, customized to each educatee's needs as they navigate the admissions process.

Source: https://pekinhardy.com/the-college-planning-lifecycle-stage-1-the-early-years/

0 Response to "Market Analysis Family Life Cyle College Savings Plan"

Post a Comment